3-D Secure Flow

SumUp is supporting 3-D Secure payments for an additional layer of security when it comes to online transactions.

EMVCo has developed 3D Secure 2, a new authentication protocol for payment card transactions, to meet the requirements of Strong Customer Authentication (SCA). This protocol will reduce fraud with its additional security layers, such as biometrics.

SCA (Strong Customer Authentication) is an obligatory security measure that relies on two-factor authentication to verify the identity of the consumer in a payment transaction. As a result, these factors are strictly consumer-based. SCA can combine two of the following three factors, which must be strictly independent of each other:

- Something the customer knows (e.g. Password, PIN)

- Something the customer has (e.g. Phone, Token generator)

- Something the customer is (e.g. Fingerprint, Face ID)

Each of these elements must be independent from each other, to ensure the security of others is not compromised in the event of a security breach.

How it works

For the flow to be followed, both the merchant profile and the customer credit card issuer must support 3-D Secure.

The flow includes an additional step during checkout, that is shown depending on the card scheme and issuing bank.

Integration for Single Payments

To begin supporting the 3-D Secure flow, add the redirect_url parameter to your create a checkout request scheme. The parameter refers to a URL where the end user is redirected once the payment processing completes.

Proceed with processing the checkout which will return a response object (next_step) containing necessary details for the following required step for processing the payment.

Use the next_step content to redirect an end user to a challenge screen. The next_step object contains:

| Parameter | Value |

|---|---|

method | POST |

url | https://issuing-bank.com/acs?reqid=B69D8F090C031E959A3BB2C4D7DFE7F8F7C09B28 |

redirect_url | https://mysite.com/completed_purchase |

mechanism | iframe or browser |

payload | object |

As an example, the payload object may look like this:

{

"arbitrary_param_name_1": "arbitrary_param_value_1",

"arbitrary_param_name_2": "arbitrary_param_value_2",

"arbitrary_param_name_3": "arbitrary_param_value_3",

"arbitrary_param_name_4": "arbitrary_param_value_4"

}

One approach for accomplishing the end user redirection is through a form:

<form

name="autoSubmitForm"

action="https://issuing-bank.com/acs?reqid=B69D8F090C031E959A3BB2C4D7DFE7F8F7C09B28"

method="POST"

>

<input

type="hidden"

name="arbitrary_param_name_1"

value="arbitrary_param_value_1"

/>

<input

type="hidden"

name="arbitrary_param_name_2"

value="arbitrary_param_value_2"

/>

<input

type="hidden"

name="arbitrary_param_name_3"

value="arbitrary_param_value_3"

/>

<input

type="hidden"

name="arbitrary_param_name_4"

value="arbitrary_param_value_4"

/>

</form>

<script type="text/javascript">

document.autoSubmitForm.submit();

</script>

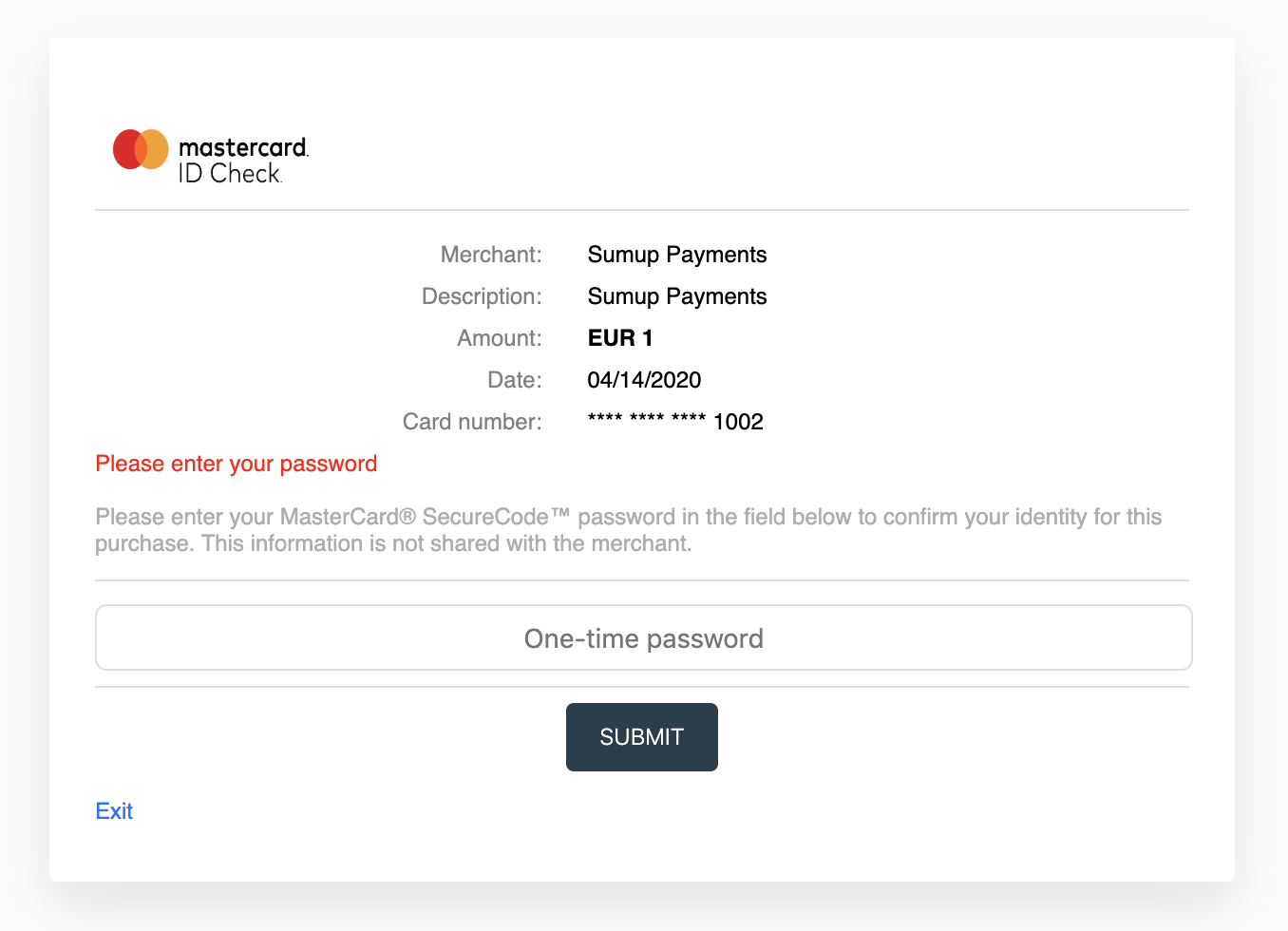

Once the form is submitted, the end user will be redirected to their issuer’s bank authentication screen, where the end-user must provide an additional authentication (e.g. a challenge token, SMS or other data). After submitting, SumUp completes the payment and the end user is redirected to the redirect_url appointed at the checkout creation, through a GET request with the corresponding checkout_id query parameter.

To confirm a checkout's status, make a GET request to the retrieve a checkout endpoint.